How Far Will Unicorn Share Prices Fall?

Cumulative losses give us some insightsMost investors know that America’s Unicorns are losing money. What they don’t know is that most Unicorns have dug big holes for themselves and aren’t sure how to dig themselves out.

What do I mean by holes? I mean massive cumulative losses that have been accumulated over many years of yearly losses. Because many of today’s Unicorn startups were founded at least 10 years ago, and are still unprofitable, they have a had a long time to create huge cumulative losses, some much more than the $3 billion that Amazon once had. The biggest losses are for Uber ($29.1 billion), WeWork ($12.2 billion), Snap ($8.7 billion), Lyft ($8.5 billion), Teledoc Health ($8.1 billion), and Airbnb ($6.4 billion), followed by four others (Nutanix, Rivian, RobinHood and Bloom Energy) with greater than $3 billion.

And many of these startups are still unprofitable and thus still accumulating more losses. By my count, only 19 of today’s 140 publicly traded ex-Unicorns (14%) were profitable in the first three quarters of 2021, up from 17 in 2020 and 13 in 2019. At this rate, a quarter of them might be profitable in the five years.

In order to becoming “cumulatively” profitable, however, they must also achieve rapid growth, and rapid growth has largely disappeared (with some exceptions) as the lockdowns have eased and people have decided they have enough exercise bikes, delivered food, and cloud computing services. The slower growth is a big reason the share prices for these Unicorns have fallen between 30% and 90% in the last six months.

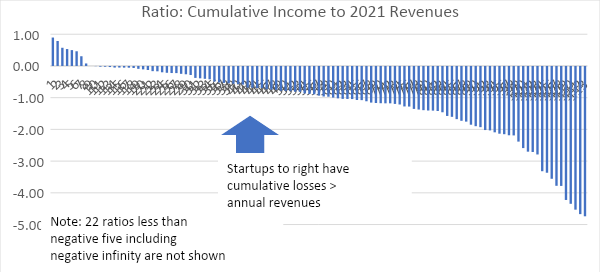

The below figure shows just how a massive a hole the Unicorns have fallen into despite the figure not showing the 22 ratios less than negative five. This figure plots the ratio of cumulative income, either profits or losses, to annual revenues in 2021. Each narrow bar represents a single startup; the startups are ordered from high ratios on the left to low ones on the right. The more positive the ratio, the greater the profits that a startup has accumulated over time, and the more negative the ratio, the greater the losses it has acquired over time, both presented as ratio of revenues.

Nine of 140 publicly traded ex-Unicorns have a positive ratio of cumulative income to 2021 revenues. The two biggest winners are Moderna and Coinbase, followed by Zoom and Etsy, along with a few others who have used their recent profits over the last few years to erase their cumulative losses and begin building up cumulative profits.

The other startups are in a far less healthy condition; 9 startups have a ratio of cumulative losses to revenues of negative infinity because they have no revenues. Another four have ratios greater than 10 and another nine have greater than five but less than 10. These 22 aren’t shown in the graph to make it more readable. The result is that we can roughly see the number of startups with cumulative losses that are greater than 2020 revenues, which is highlighted by the arrow and labeled “-1.”

The reason for focusing on negative one is because it highlights the problems associated with erasing cumulative losses. Even if a startup were to magically achieve profits equal to 10 percent of revenue, a truly difficult feat for many of today’s Unicorn startups, it would still take 10 years to erase the cumulative losses. Although Amazon managed to achieve this and later become one of America’s most valuable companies, few startups will likely repeat Amazon’s success, because Amazon is an outlier, clearly the best of the best. Furthermore, many of these 89 ex-Unicorns cited above have cumulative losses much greater than their annual revenues, and not just equal to annual revenues as Amazon had.

Startup proponents will argue that these startups can become profitable, and they can use these profits to erase their cumulative losses. Yes, this is possible. But the real question is whether there is a high probability of this occurring. When startups have been losing money for years, why should they suddenly become profitable, much less sufficiently profitable to erase their cumulative losses? And is it likely they will be able to do this while maintaining rapid growth rates so that the profits, when they do appear, will be large enough to offset the billions in losses some have accumulated over many years of annual losses?

Rising interest rates exacerbates the problems from cumulative losses. For instance, Carvana was recently forced to pay 10.25% on their newest bonds, meaning they will be paying more than $170 million each year just on their cumulative losses of almost $1.7 billion. Imagine if Uber had to pay 10% in interest charges on its almost $25 billion in cumulative losses; just servicing this debt would cost $2.5 billion a year or about 15% of 2021 revenues. Another way to express the problem with 10% interest rates is to move the line in the above figure from negative one to -0.90 to reflect the need to service the debt. When inflation is 8% or so, interest charges for risky money losers may reach 10%, thus causing more startups to have greater cumulative losses than revenues.

This is one reason why startups with the largest cumulative losses, both in absolute terms and as a ratio of revenues, is important. With 56% of the 140 publicly traded Unicorns having cumulative losses greater than or equal to revenues, many are in danger of never being able to erase their cumulative losses. This high percentage also suggests many of the 1,100 privately held Unicorns, currently valued at $3.67 trillion, may also have cumulative losses greater than revenues, and thus are in risk of never erasing their cumulative losses. The risks associated with startups will continue to rise as interest rates are increased, or there is a perception they will be increased.

You may also wish to read: Is rationality finally emerging for unicorn share prices? Share prices are falling as losses continue to mount. There is good news of profitable ex-Unicorns, but a trend towards stronger profitability is fairly weak. (Jeffrey Funk)