In the Digital World, What Does “Scarcity” Mean?

For a digital artwork like Beeple’s Everydays, which sold for over $69 million, a number of methods are used to prevent copying, thus ensuring uniquenessIntroduction: At Expensivity, Bernard Fickser explains that a non-fungible token (NFT) is a unique token in cryptography that represents, say, real estate or art rather than money. Because the tokens have unique identities (non-fungible), they can be bought or sold while reducing the risk of fraud.

So how do they work?: The series is called How Non-Fungible Tokens Work: NFTs Explained, Debunked, and Legitimized (July 30, 2021). In Part 5, we look at how scarcity, central to the economic value of works of art, can be created in the digital world, where copying is generally quite easy:

5 Digital Scarcity

When jumping into the world of NFTs, one finds a certain breathless awe in the face of blockchain technology. One even hears that blockchain has for the first time made if possible to create digital scarcity, as though scarcity of physical goods is the only type of scarcity that existed before blockchain was invented. Such a claim is both misleading and ludicrous.

First off, it bears repeating that blockchain is a ledger security technology. In other words, its whole point is to keep ledgers secure from tampering. But ledgers have been kept secure by various means for centuries. Notarization using time-date stamps along with attestation by witnesses is old and well proven. It is still used to set up bank accounts and to buy and sell property. Independent accountants who keep parallel books provide another form of security (if the books don’t match, there’s been a mistake or tampering). I’m not saying these are best or foolproof, or that blockchain may not be better. I am saying there are alternatives.

The use of peer-to-peer distributed systems to implement blockchain should not be regarded as a magic bullet. Such systems constitute third parties, and the claim that they don’t require trust (i.e., that they’re “trustless”) is naive. Blockchain technology is consensus based, which in practice means majority rule (the slogans “decentralized” and “democratic” supposedly providing legitimation). But the problem with majority rule is that the majority can do anything it wants.

What, then, is digital scarcity? In the physical world, scarcity is obvious and looks like this: There are only a fixed number of items answering to a given criterion or specification. Take, for instance, barrels of crude oil. There are only so many produced on a given day. There are only so many that can be produced on a given day, given maximal production. In the state of California or Texas there are only so many barrels that can be extracted to the end of time. Note that scarcity for physical items comes in degrees and admits numerical comparisons. If the criterion for scarcity is weight, then diamonds are scarcer than crude oil.

What, then, does digital scarcity look like? Given that a digital item is just a file consisting of bits that can be copied with complete fidelity once the full file is in hand, digital scarcity cannot mean a limit on the number of such copies, since there can be no such limit for digital files. Scarcity must therefore mean some limitation on the digital file in question, limiting access to it or the ability to make certain changes to it. Moreover, such limitations can only arise with the originator of the file by baking in such limitations from the start. Digital scarcity therefore can only mean one of three things (these are exhaustive though not mutually exclusive):

- Partial Availability. The full digital item is unavailable but instead only a partial form of it is available, whose copying or use is regarded as unproblematic. The partial form of the digital item thus constitutes an approximation of or limited access to the full item, the full item being kept inaccessible except to certain authorized parties.

- Digital Marking. The digital item is marked in such a way as to identify the author of the mark or otherwise distinguish it. The mark can be hidden, invisible to people viewing the item, though becoming plain once it is pointed out. Or the mark can be evident from the start. Scarcity of the item may consist of the presence of the mark or its absence.

- Algorithmic Immutability. The digital item is the output of an algorithm whose operation has followed a clear and verifiable path, and there’s no way to change the output given the history of the algorithm’s behavior to that point.

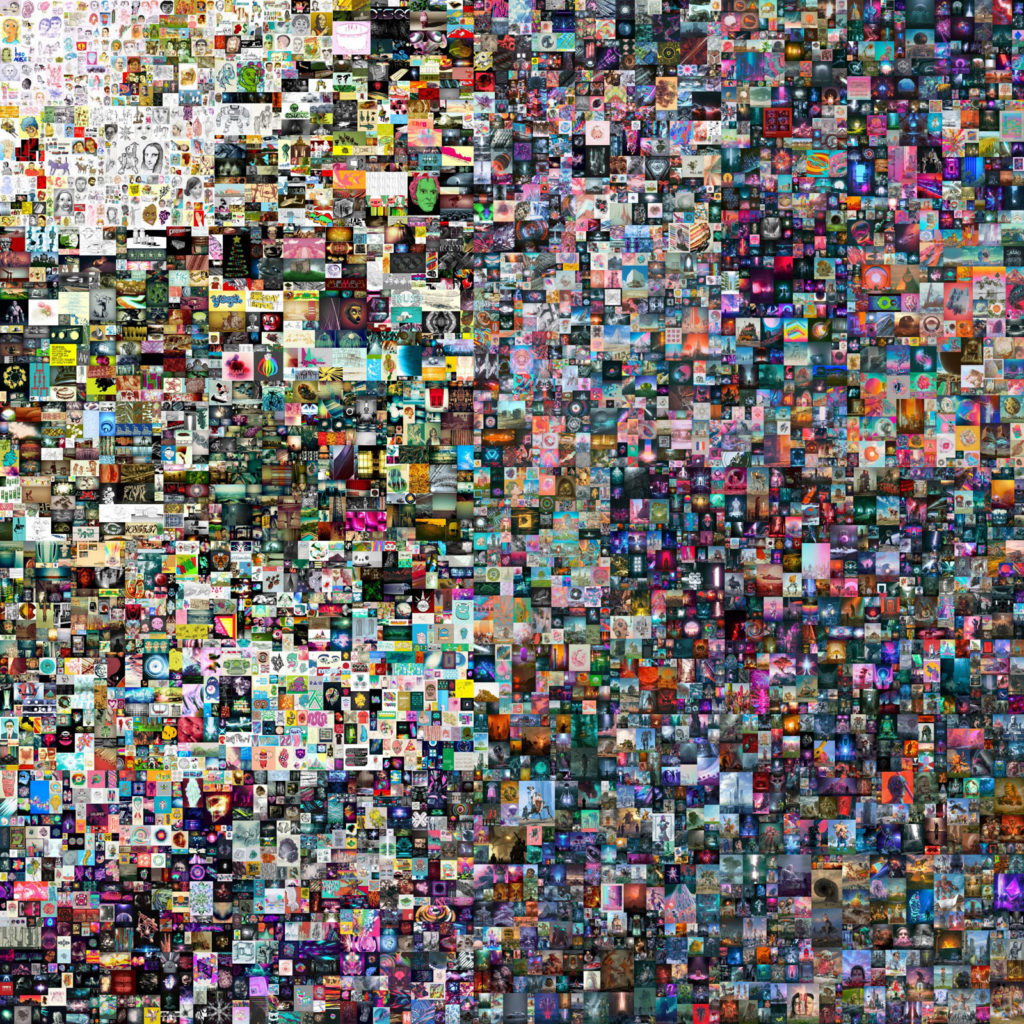

To illustrate these three points, I’m going to review the sale of the artist Beeple’s (aka M.J. Winkelmann’s) NFT titled Everydays: The First 5,000 Days. This is the highest priced NFT ever sold, selling on March 11, 2021 at Christie’s auction house for 42,329 Ether, which at the time amounted to over $69 million.

Licensed via Adobe Stock

Licensed via Adobe StockThe above representation of Everydays: The First 5,000 Days is a 1,600 x 1,600 pixel jpeg image. As such, it is a low-res partial image of this digital work of art. The jpeg above is just a little over 1 megabyte. The full image that was on sale at Christie’s came to 21,069 x 21,069 pixels and weighed in at over 319 megabytes. This full image was part of the Christie’s sale and went to the winning bidder, namely, Vignesh Sundaresan (aka MetaKoven).

This disparity between a partial jpeg image of Everydays, which was used by the auction house to represent the work of art to potential bidders, and the full image that constitutes the actual work of art, illustrates the partial availability form of digital scarcity. The full image also raises some interesting questions of its own. It’s certainly large as jpeg images go (over 319 megabytes). But as a collage of 5,000 images (one created everyday by Beeple since 2007), it actually does little justice to the original images.

If you visit Beeple’s website, you will find individual jpeg images of the sort that Beeple used to populate the Everydays collage—the types of images that he produced one a day over 5,000 days. These images are on average about 3 megabytes. So if Everydays fully represented each of the images in the collage, the file size should have come to 3 megabytes x 5,000, or about 15 gigabytes, or about 50 times the size of the image that was put up for sale. As it is, each image making up the collage can have only about 319 megabytes ÷ 5,000 on average, or just under 64 kilobytes. The purchaser of this collage might therefore have insisted on including in the sale all the individual images making up the collage.

If the winning bidder Vignesh Sundaresan was only interested in acquiring the 21,069 x 21,069 pixels jpeg image of Everydays, and if that’s what he paid $69 million for, he would be playing a dangerous game. Individual self-contained files are easily hacked and copied. For his purchase to be safe and make any sort of sense, there had to be more to it than simply this large jpeg file, and there was.

This takes us to the second form of digital scarcity listed above: digital marking. The purchaser of Everydays, in addition to receiving the full high-res jpeg of this digital work of art, had it signed over to his Ethereum address by Christies once he paid for the work in Ether. It’s that cryptographic signature consistent with Ethereum protocols that’s the value-add here and what Sundaresan ultimately paid for.

Because the actual work of digital art was too storage-intensive to put on the Ethereum block chain, storage of the work had to be put in one place and its signature on the Ethereum blockchain in another place, with a pointer connecting the two. But conceptually, what Sundaresan purchased was a signed version of Beeple’s Everydays, signed by Christie’s and assigned to Sundaresan. This signed assignment of the work constituted a digital marking. Only Christies could impose that digital marking with itself as the assignator and Sundaresan as the assignee.

Note that digital marking is not confined to cryptographic digital signatures. The field of digital data embedding technologies (everything from watermarking to steganography, which introduces hidden messages into digital files having a clear surface meaning) also answers to this form of digital scarcity. Thus via steganography one might adjust pixels in a jpeg image so that they spell out some message (e.g., “this is not the original file”) or one might watermark it as a sign of authenticity or inauthenticity. This is well trodden territory and it predates blockchain.

The final form of digital scarcity to be considered is algorithmic immutability. It obviously calls to mind blockchain, where a well-defined peer-to-peer software implementation of a blockchain protocol (which constitutes the algorithm) can only produce outputs consistent with prior blocks. Cryptocurrencies clearly need algorithmic immutability because you can’t just have new coins emerging from nowhere.

At the same time, it’s hardly the case that blockchain is the only way to achieve algorithmic immutability. The current state of a system may be reliably determined without blockchain technology (perhaps by such low-tech means as attestation by human witnesses), whereupon the algorithm operates as it must. Our present banking system, without the aid of blockchain, operates by algorithmic immutability.

Beeple and Christie’s together ensured that Everydays would reside on the Ethereum blockchain, thus also conferring algorithmic immutability as a form of digital scarcity onto this work of art. But as with partial availability, this form of digital scarcity seems less essential to what makes Everydays valuable. If the full 319 megabyte jpeg of Everydays suddenly appeared online, Sundaresan would still own the image in the sense that he would be the winning bidder in the auction for it and Christie’s would be signing it over to him and no one else.

That it was signed over to him on the Ethereium blockchain, or any blockchain for that matter, seems unessential. Christie’s and Sundaresan, for instance, could each have set up a private/public cryptographic key for themselves, and Christie’s could then have signed over Everydays from its key to Sundaresan’s. The public keys and the signing over of the artwork using private keys would have been noted far and wide given all the public attention to this sale, and Sundaresan could have paid for it in any currency mutually agreed upon by the buyer and auction house. Blockchain could thus have been sidelined.

This last point may seem counterintuitive and even absurd, given the current hype over blockchain in cryptocurrencies and NFTs, but I’ll justify it more fully in the next two sections. For now, however, it remains the case that all three forms of digital scarcity outlined in this section appeared in the sale of Beeple’s Everydays.

Next: 6 Value and Ownership of NFTs

Here are all the parts of the series, 1 through 7:

Part 1: Cryptography: Are non-fungible tokens a scam? Or can they work? By Warren Buffett’s logic, if cryptocurrencies are rat poison squared, non-fungible tokens are rat poison to an infinite power. But is that all there is to be said about them? Blockchain technology allows for digital collectibles to be scarce even if they are replicable, thus creating value, like Jack Dorsey’s famous initial tweet.

Part 2: Can digital signatures protect NFTs in digital marketplaces? The concept of owning an NFT on a blockchain is specific to the blockchain with no legal force in society at large. While NFTs are new, the debasement of value by proliferating copies whose marginal value is close to zero has a long and ignominious history.

Part 3: How to create non-fungible tokens (NFTs), simplified. While still deeply skeptical of what ownership of an NFT really means at present, Fickser decided to experiment with creating, buying, and selling NFTs. Bernard Fickser offers a step-by-step explanation, offering an original montage of the Democratic primary in Iowa in 2007 for sale as an illustration.

Part 4: NFTs: You bought one. But do you really own it? Could you ever? Right now, the non-fungible tokens markets leave a lot to be desired as a business proposition, Bernard Fickser explains why. The current NFT regime features no limit on proliferation, no guarantee of scarcity, and terms that disclaim any accountability on the part of the NFT market.

Part 5: In the digital world, what does “scarcity” mean? For a digital artwork like Beetle’s Everydays, which sold for over $69 million, a number of methods are used to prevent copying, thus ensuring uniqueness. Three methods used to ensure uniqueness include partial availability (for fair use), digital marking, and algorithmic immutability (like blockchain).

Part 6: What makes NFTs valuable? What does it mean to own one? In the case of non-fungible tokens (NFTs) on the Ethereum blockchain, actual ownership with legal standing is never in fact transferred for the underlying digital file. Bernard Fickser points out that the NFT literature is filled with equivocations about the meaning of the word “own” as it relates to NFTs.

Part 7: How can non-fungible tokens (NFTs) be made to work better? Bernard Fickser offers twelve steps to handling NFTs in a way that dispenses with cryptocurrency-based blockchains and works in ordinary online marketplaces like eBay. In Fickser’s view, NFTs can work if they avoid self-serving cryptocurrency blockchains like Ethereum and enable real-world legal transfers of ownership.

Also: Jonathan Bartlett’s response: Blockchains have NFTs unnecessarily tied down. New ideas propose severing the accidental relationship between NFTs and blockchains. For NFTs, the blockchain is actually reducing the value of the NFT, as it introduces additional dependencies and costs for maintaining NFTs